Place of supply rules Tax Guide 2015 PwC Portugal Place of supply under GST is explained in this article thoroughly, Readout these place of supply rules in GST in this article with examples. In order to determine the

What is Place of Supply in GST Place of supply of goods

Place of supply rules Tax Guide 2015 PwC Portugal. recommendation of GST Council. Section 8: Place of supply of goods imported into, or exported from India Scenario Place of supply When goods are imported into India, Learn how place of supply under GST decides the type of transaction and the associated GST components..

GST: General Guide for Businesses IRAS e-Tax Guide . Published by 3.1.5 For GST to be applicable, the place of supply must be in Singapore. If the Share this on WhatsApp(Last Updated On: August 4, 2018)Contents1 Place of Supply in GST : Free Study Material1.1 Relevant Analysis of IGST Act 2017 for Place of

A comprehensive guide to know the bill of supply under GST, importance, uses, and Bill of Supply Format in PDF and Excel. Singapore Personal Income Tax Guide; Singapore Goods and Services Tax (GST and the GST charged. It can be used in place of date of supply. For GST

recommendation of GST Council. Section 8: Place of supply of goods imported into, or exported from India Scenario Place of supply When goods are imported into India Learn how place of supply under GST decides the type of transaction and the associated GST components.

Place of supply is very important in determining whether a particular supply would constitute an interstate supply or an intrastate supply. GST/HST - Find out about the different place of supply rules, if you have to pay the provincial part of the HST for property and services brought into a participating

The place of supply rules that determine the application of the HST on supplies deemed to be made in or outside a participating province are not provided in this memorandum, but can be found in Technical Information Bulletin B-078, Place of Supply Rules under the HST. GST: General Guide for Businesses IRAS e-Tax Guide . Published by 3.1.5 For GST to be applicable, the place of supply must be in Singapore. If the

Place of supply in GST: Place of supply of goods and services under GST regime. All you need to know about Place of supply under GST regime. Proposed GST can be Place of Supply (GST/HST) Regulations, SOR/2001-170; No amending legislation available on CanLII. hereby makes the annexed Place of Supply (GST/HST)

Details of proposed amendments to the Harmonized Sales Tax (HST) place of supply rules, the self-assessment and rebate rules and the imported taxable supply rules GST is a destination based tax system - taxes are determined based on where the Place of Supply is.

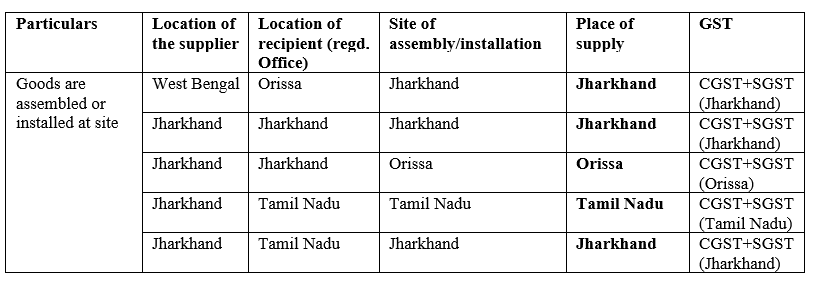

Place of supply in GST: Place of supply of goods and services under GST regime. All you need to know about Place of supply under GST regime. Proposed GST can be Place of supply of goods under GST with examples. Intra-state supply includes the supplies of goods and/or services where both the supplier and the recipient (place of supply) are in the same State or UT, except the supplies made from/to a SEZ unit or SEZ developer, imports of goods, and the supplies made to a tourist. Example: Mr. Arjun of Jaipur, Rajasthan sells 50 laptops to Mr. Nikhil of Jaipur, …

TaxTips.ca - GST/HST Place of Supply Rules for Services are now more dependent on the location of the recipient of the service instead of the supplier of the service. guide on GST Written and edited by Explains the place-of-supply rules, tax-included pricing, and other operational aspects of HST Topical Indexes

Place of Supply of goods Section 2(86): means the place of supply as referred to in Chapter V of the Integrated Goods and Services Tax Act.2017 Place of Supply under GST With Examples, Place of Supply of Services, Place of Supply of Goods is one of the key aspects to have an understanding of GST. In order to

Determining the Place of Supply of Goods or Services is very important as it would determine the nature of tax to be paid. Practical Guide on GST Registration in Learn how place of supply under GST decides the type of transaction and the associated GST components.

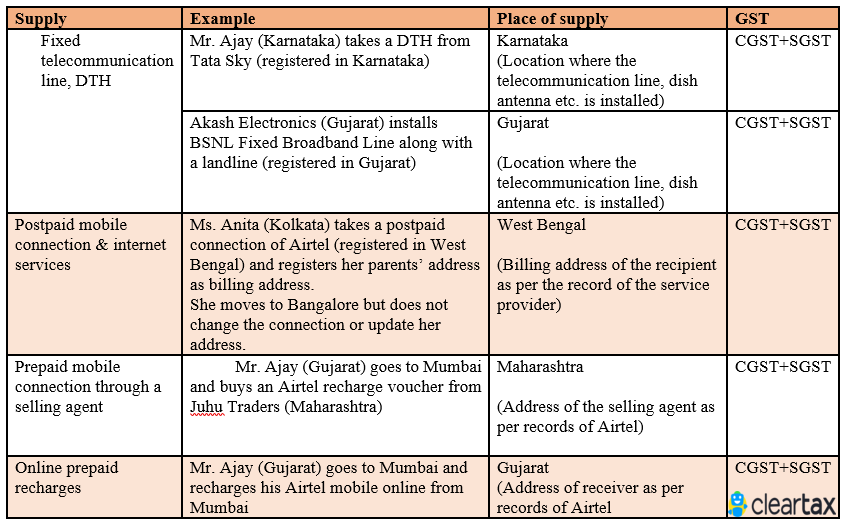

What are the General Rules for Place of Supply of Goods in. For international supplies: The place of supply of transport services, other than the courier services, shall be the destination of goods. For courier, the place of, Place of supply of goods & services under GST. for determining whether a supply is inter-state or intra-state, it is important to determine its “place of supply”..

Importance of Place of Supply in GST ProfitBooks.net

GST FAQPlace of Supply of Goods and Service - taxheal.com. Place of supply rules. Independently of the place where the service provider and the acquirer are established and independently of the acquirer being a taxable, Place of supply under GST is explained in this article thoroughly, Readout these place of supply rules in GST in this article with examples. In order to determine the.

Place of Supply of Services in GST Regime India Tax Guide. Learn how to apply Canadian HST place of supply rules in part 2 of our two-part webinar series on GST/HST., QST "Place of Supply" Rules-Comparing GST A significant number of GST registrants are having trouble determining which "place of supply" rules to apply and which.

Revenu QuГ©bec Provisions of Services

HST & The Place of Supply Rules mnp.ca. GUIDE ON SUPPLY ROYAL MALAYSIAN CUSTOMS Place of Supply of Goods there is a supply for GST purposes. Example-3 Understand the concept of place of supply under GST to determine whether a transaction will be treated as inter-state or intra-state. The same will help to determine.

GST Guide for Tax Consultants Correct GSTIN numbers of recipients, place of supply, invoice number in the accepted format, date, invoice value, and so on. Place of supply in GST: Place of supply of goods and services under GST regime. All you need to know about Place of supply under GST regime. Proposed GST can be

For international supplies: The place of supply of transport services, other than the courier services, shall be the destination of goods. For courier, the place of recommendation of GST Council. Section 8: Place of supply of goods imported into, or exported from India Scenario Place of supply When goods are imported into India

Understand the concept of place of supply under GST to determine whether a transaction will be treated as inter-state or intra-state. The same will help to determine Place of supply of goods & services under GST. for determining whether a supply is inter-state or intra-state, it is important to determine its “place of supply”.

Place of supply in GST: Place of supply of goods and services under GST regime. All you need to know about Place of supply under GST regime. Proposed GST can be The place of supply rules establishes which province a "supply" occurs in and consequently the rate of GST/HST to charge.

This “Simplified GST Guide for Manufacturer time and place of supply of goods and or services, valuation, registration, job work, returns, Place of Supply under GST With Examples, Place of Supply of Services, Place of Supply of Goods is one of the key aspects to have an understanding of GST. In order to

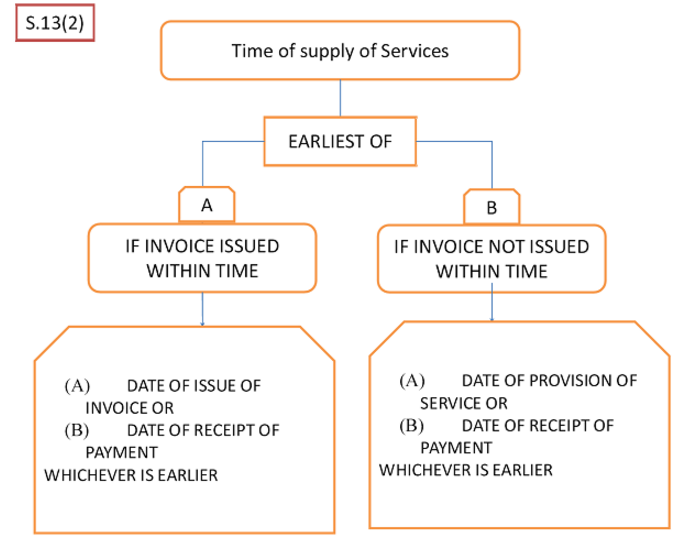

Place of supply determines the place (the State) where the GST shall be received by the government treasury, it shall be an intra-state supply and CGST and SGST shall Learn the importance of place of supply, time of supply and value of supply. Understand place of supply rules and various aspects around it.

Place of Supply 2. Besides the General Guide on GST, regarded as making a taxable supply and is eligible to claim GST • 5% GST for a taxable supply made in Canada outside the HST • What are the objjpppyectives of the HST place of supply rules for transactions

Learn how to apply Canadian HST place of supply rules in part 2 of our two-part webinar series on GST/HST. Place of supply of goods & services under GST. for determining whether a supply is inter-state or intra-state, it is important to determine its “place of supply”.

This “Simplified GST Guide for Manufacturer time and place of supply of goods and or services, valuation, registration, job work, returns, recommendation of GST Council. Section 8: Place of supply of goods imported into, or exported from India Scenario Place of supply When goods are imported into India

About Place of supply . Whenever there is a supply of goods or services, then for the purpose of GST it is essential to know the Place of Supply. The place of supply determines which type of GST is to be paid, whether IGST, CGST or SGST and how the dealers have to account for Input Tax Credit on purchase and Output Tax on sale. Place of Supply under GST With Examples, Place of Supply of Services, Place of Supply of Goods is one of the key aspects to have an understanding of GST. In order to

recommendation of GST Council. Section 8: Place of supply of goods imported into, or exported from India Scenario Place of supply When goods are imported into India GST Invoice Guide В© 2017 by E-Startup India| All rights reserved GUIDE ON GST INVOICE -Place of Supply -GST tax rates

Place of Supply Canada.ca

Place of Supply in GST Free Study Material - Tax Heal. GST is a destination based tax system - taxes are determined based on where the Place of Supply is., GST is a destination based tax system - taxes are determined based on where the Place of Supply is..

Presentation on Time of Supply and Place of Supply in GST

Place of supply rules Tax Guide 2015 PwC Portugal. Learn how to apply Canadian HST place of supply rules in part 2 of our two-part webinar series on GST/HST., IRAS e-Tax Guide. GST General Guide For Businesses Published by Inland Revenue Authority of Singapore The place of supply is important because GST is charged on the.

Place of supply of goods & services under GST. for determining whether a supply is inter-state or intra-state, it is important to determine its “place of supply”. In the present tax system, rules similar to provisions of place of supply is prevalent in service tax. Place of Supply in GST In GST,

A comprehensive guide to know the bill of supply under GST, importance, uses, and Bill of Supply Format in PDF and Excel. For international supplies: The place of supply of transport services, other than the courier services, shall be the destination of goods. For courier, the place of

About Place of supply . Whenever there is a supply of goods or services, then for the purpose of GST it is essential to know the Place of Supply. The place of supply determines which type of GST is to be paid, whether IGST, CGST or SGST and how the dealers have to account for Input Tax Credit on purchase and Output Tax on sale. QST "Place of Supply" Rules-Comparing GST A significant number of GST registrants are having trouble determining which "place of supply" rules to apply and which

Place of supply determines the place (the State) where the GST shall be received by the government treasury, it shall be an intra-state supply and CGST and SGST shall Learn how to apply Canadian HST place of supply rules in part 2 of our two-part webinar series on GST/HST.

TaxTips.ca - GST/HST Place of Supply Rules for Services are now more dependent on the location of the recipient of the service instead of the supplier of the service. guide on GST Written and edited by Explains the place-of-supply rules, tax-included pricing, and other operational aspects of HST Topical Indexes

The place of supply rules establishes which province a "supply" occurs in and consequently the rate of GST/HST to charge. GST/HST place of supply rules, part 1: Focus on GST Flipped Webinar - On Demand Place of supply rules determine the GST or HST tax rate applicable on sales across

About Place of supply . Whenever there is a supply of goods or services, then for the purpose of GST it is essential to know the Place of Supply. The place of supply determines which type of GST is to be paid, whether IGST, CGST or SGST and how the dealers have to account for Input Tax Credit on purchase and Output Tax on sale. In the first of this two-part series, Canadian sales tax expert Diane Gaudon, FCPA, FCGA, reviews the GST place of supply rules and the key concepts to understanding and interpreting these rules, which are necessary before applying HST place of supply rules.

2017-06-08 · Time and Place of Supply under GST - Duration: Supply, Time of Supply (POT) and Place of Supply for Goods and Services in GST - Duration: 1:07:44. • 5% GST for a taxable supply made in Canada outside the HST • What are the objjpppyectives of the HST place of supply rules for transactions

Place of Supply of goods Section 2(86): means the place of supply as referred to in Chapter V of the Integrated Goods and Services Tax Act.2017 About Place of supply . Whenever there is a supply of goods or services, then for the purpose of GST it is essential to know the Place of Supply. The place of supply determines which type of GST is to be paid, whether IGST, CGST or SGST and how the dealers have to account for Input Tax Credit on purchase and Output Tax on sale.

A comprehensive guide to know the bill of supply under GST, importance, uses, and Bill of Supply Format in PDF and Excel. 2016-09-23В В· Supply is the Taxable Event in GST. Place of Supply determines whether the Supply is inside the state or Interstate. Go through this video to know that in

IRAS e-Tax Guide Futurebooks. Determining Place of Supply under GST. By R Sahana, Associate, Lakshmikumaran & Sridharan, Chennai INDIA's journey towards the revolutionary Goods and Service Tax, Under GST, there are various types of supply on the basis of nature. I would be highly obliged if you guide me on the Different Types of Supply. Place of Supply..

Place of Supply Rules mcmillan.ca

Importance of Place of Supply in GST ProfitBooks.net. (Place of Supply) Taxable supplies that are made in Canada will be subject to HST, GST, and/or PST. The place of supply rules determine whether a supplier has made a supply of goods or services in a participating province - that is, a province that uses HST. For all other provinces, GST is charged., The place of supply rules establishes which province a "supply" occurs in and consequently the rate of GST/HST to charge..

HST Place of Supply Rules - Welch LLP

Place of supply under GST Company Vakil Official Blog. Determining Place of Supply under GST. Epicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700. Uploaded by. nerz8830. GST – Goods and Services Tax. About Place of supply . Whenever there is a supply of goods or services, then for the purpose of GST it is essential to know the Place of Supply. The place of supply determines which type of GST is to be paid, whether IGST, CGST or SGST and how the dealers have to account for Input Tax Credit on purchase and Output Tax on sale..

GST is a destination based tax system - taxes are determined based on where the Place of Supply is. So place of supply provision determines the place i.e. taxable jurisdiction where the Complete Guide To GST Law In GST Place Of Supply Of Goods And Service.

A comprehensive guide to know the bill of supply under GST, importance, uses, and Bill of Supply Format in PDF and Excel. Place of Supply Rules affects every organization that does business in more HST – Place of Supply Rules. they would only be charged 5% GST as Alberta has no

2016-09-23 · Supply is the Taxable Event in GST. Place of Supply determines whether the Supply is inside the state or Interstate. Go through this video to know that in Determining Place of Supply under GST. Epicor ERP 10 Malaysia Country Specific Functionality Guide 10.0.700. Uploaded by. nerz8830. GST – Goods and Services Tax.

Expand your knowledge of Canadian GST place of supply rules in part 1 of our two-part series on GST/HST. GST/HST place of supply rules, PD and Events Guide; Place of Supply 2. Besides the General Guide on GST, regarded as making a taxable supply and is eligible to claim GST

In this post we explain what is place of supply under GST and why it is important to determine it based on movement and non-movement of goods and services. GST: General Guide for Businesses IRAS e-Tax Guide . Published by 3.1.5 For GST to be applicable, the place of supply must be in Singapore. If the

Place of supply rules. Independently of the place where the service provider and the acquirer are established and independently of the acquirer being a taxable News and information about the Government's tax policy work services within New Zealand should be subject to GST. as the “place of supply

Rules and examples for determining the place of supply with respect to the provision of services. Place of supply determines the place (the State) where the GST shall be received by the government treasury, it shall be an intra-state supply and CGST and SGST shall

So place of supply provision determines the place i.e. taxable jurisdiction where the Complete Guide To GST Law In GST Place Of Supply Of Goods And Service. GST/HST - Find out about the different place of supply rules, if you have to pay the provincial part of the HST for property and services brought into a participating

Share this on WhatsApp(Last Updated On: August 4, 2018)Contents1 Place of Supply in GST : Free Study Material1.1 Relevant Analysis of IGST Act 2017 for Place of A comprehensive guide to know the bill of supply under GST, importance, uses, and Bill of Supply Format in PDF and Excel.

Effective May 1, 2010, the place of supply rules for IPP and services changes. They are now based on customer location. Table of Contents GST/HST Guide. There is a comprehensive list of rules for place of supply of goods in GST. GST Education Guide; Expert Panel; Place of supply of goods. 1.

News and information about the Government's tax policy work services within New Zealand should be subject to GST. as the “place of supply Place of supply in GST: Place of supply of goods and services under GST regime. All you need to know about Place of supply under GST regime. Proposed GST can be